Pygma Acquires Scala and develop the most disruptive VC fund in Latam

The acquisition allows Pygma to invest in the best tech-startups in Latam, including the best performers of their acceleration programs.

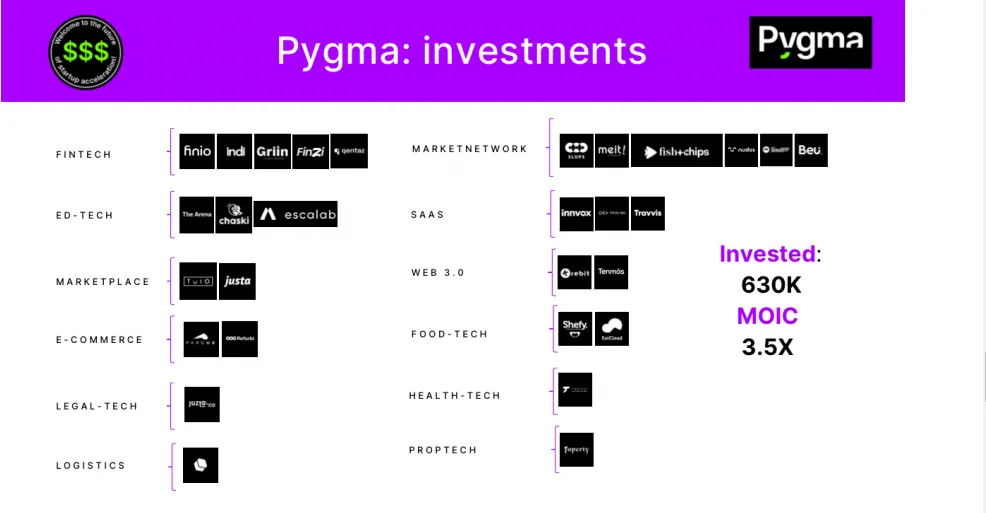

Daniel Ospina, founding partner of Scala will be joining Pygma as co-founder & venture hacker, strengthening the venture capital arm and the vision of having a strong VC network in Latam in addition to their accelerator that have accelerated 82 companies, 150+ founders and 29 investments in pre-seed tech startups in Latam from Colombia, Brazil, Mexico, Venezuela, Argentina, Chile, Peru, Ecuador & Costa Rica

The move to acquire Scala first started 3 months ago when Pygma announced their interest of injecting capital into their startups. The process took [3.5 months] and the deal was signed in [20 July 2022].

“The negotiations were tough, but fun”, said. In the end, we will continue developing and growing the startup ecosystem together with a full circle approach having acceleration and funding as two of our pillars to continue building our community.”

Andres Cano, Co-founder at Pygma

According to Daniel Ospina, the goal is to be the most disruptive VC fund in Latam. The venture team is currently at VC Lab developing the coming fund structure and thesis, as they will be launching their second fund soon. This will allow Pygma to gain an advantage over regular VCs that don’t have the acceleration side and don’t have constant dealflow or ways to engage in a hands-on-approach with founders.

The acquisition of Scala fits into Pygma’s investing strategy in tech startups to expand their presence in Latam. Pygma was able to close Stonks as the platform for their first demo day. Becoming one of the few Latin partners in the platform. They will be showcasing 10 of their best startups August 2nd this year. Save your spot to attend here.

“We could now offer capital to the startups accelerated in our program and continue driving innovation in the space”

Andres Campo, Co-founder at Pygma

Finally, our batch 2 is now open for applications, the program consists of 10 weeks of intensive and continuous learning in areas like data, product, go-to-market, fundraising and many more. The accelerator only takes 1% equity, allowing founders to keep exploring other acceleration options and gaining insights from great mentors, founders and an ever growing online community.